Sustainability

At Arion Bank we are dedicated to creating a good bank which operates responsibly and provides its customers with quality service. Our role is to help our customers, individual, corporate and investors, to reach their goals. Arion Bank underlines its status as a sustainable bank by making a difference to our customers and performing our role as a financial institution conscientiously and responsibly.

We place great importance on doing things fairly with the interests of our customers, employees, shareholders and the community at heart. The employees are guided by the Bank’s cornerstone values: we make a difference, we say what we mean and we get things done. The cornerstones are further outlined in the strategy and vision section. The Bank’s code of ethics also serve as a key to responsible decision-making at Arion Bank. The code of ethics has been approved by the Board of Directors.

A new policy on sustainability devised

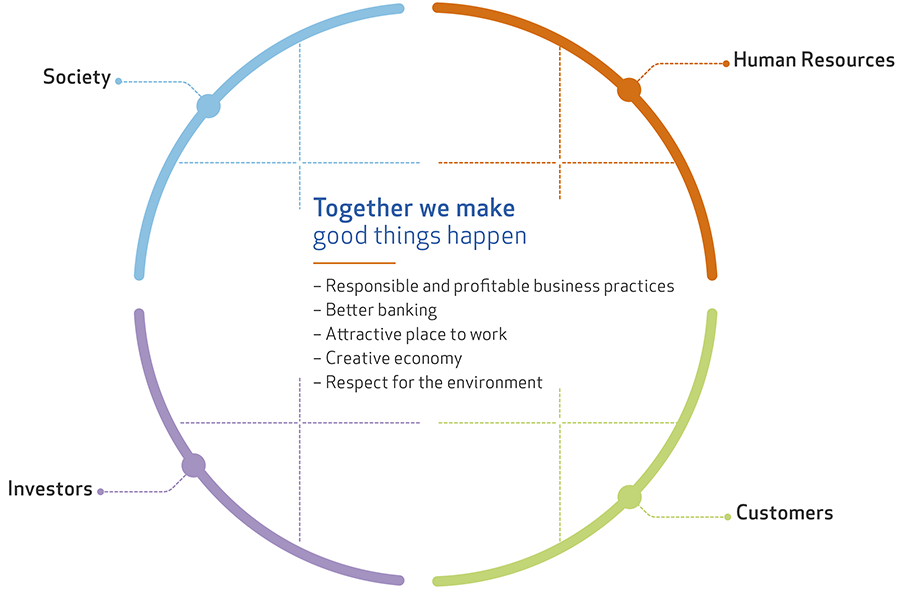

In 2016 a new policy on sustainability was devised at Arion Bank, in which the main focuses and stakeholders are defined. The policy builds on the culture which has evolved at the Bank and the work undertaken in recent years, particularly in respect to financial education, innovation and better banking. The policy is entitled Together we make good things happen. At the beginning of the year the employees came together for the annual Arion Bank Day and participated in a brainstorming session on sustainability that contributed to the creation of the new policy. The executive management also took part in a workshop on sustainability, while interviews were taken with people across the Bank and members of the Board. During this process we were assisted by consultants from KPMG in Iceland and Sweden.

The policy builds on the culture which has evolved at the Bank and the work undertaken in recent years

The new policy was presented to the employees and approved by the Board of Directors in late 2016. A number of other projects concerning sustainability were launched during the year.

At the end of 2016 Arion Bank became a signatory to the UN Global Compact initiative on corporate sustainability. In the annual report we take into account the 10 principles laid out in the Global Compact. In addition we use recent guidelines set out by World Federation of Exchanges for listed companies which concern non-financial disclosure. The objective of these guidelines is to fulfil certain aspects of the Global Reporting Initiative, an international standard which helps companies and institutions report information on sustainability in a transparent manner.

At Arion Bank we aim to ensure that sustainability is part of the Bank's day-to-day activities, its decision-making and processes. Instead of preparing a separate report on sustainability, the topic is covered in the Bank's annual report and a special environmental report for 2016 as well as an ESG overview are a part of the annual report.

Instead of preparing a separate report on sustainability at Arion Bank, the topic is covered in the Bank's annual report and a special environmental report for 2016 is a part of the annual report.

Sustainability policy

Together we make good things happen

We want to act as a role model in responsible and profitable business practices, taking into account the environment, the economy and the society in which we live and work. We try to see things from our customers’ viewpoint and strive to do better today than we did yesterday.

We work in an attractive workplace where knowledge creates future value for the benefit of our customers, investors and society as a whole.

The diagram below shows the main stakeholders at the Bank and our main areas of focus with respect to sustainability.

Responsible and profitable business practices

We place a strong emphasis on responsible and sound business practices and we strive to set a good example in this respect. When making decisions we seek to evaluate the many different interests at stake. The long-term view is of more importance than short-term considerations. We assess the possible gains and risks involved in the decisions and loans we make with regard to the many different interests at stake.

In recent years we have collaborated on a wide range of exciting investment projects with our customers with the aim of strengthening the business sector in this country. Our Investment and Underwriting Committee makes decisions on investments and the sale of assets and we have focused on gradually divesting the companies we own but which are in unrelated areas of business. One of our objectives has been to list companies on the stock market and we have been involved in around 60% of IPOs on recent years. This has been an integral part of the process of regenerating the Icelandic stock market and increasing the number of investment opportunities on the general market.

One of our objectives has been to list companies on the stock market and we have been involved in around 60% of IPOs on recent years. This has been an integral part of the process of regenerating the Icelandic stock market and increasing the number of investment opportunities on the general market

We have a project team which is drawing up a policy for responsible investment at Arion Bank. The focus is on own investments, asset management and lending activities.

Internal rules and controls

We are well aware that the Bank’s activities have an impact on different groups and on society as a whole. We have established procedures, a code of ethics and policies on different aspects of operations, including disclosure, information security, money laundering and equal opportunities.

The Bank’s code of ethics is designed to foster responsible decision-making at Arion Bank. It applies equally to the Board of Directors, management and other employees. It is the responsibility of the CEO to ensure that the code of ethics is enforced. The code of ethics is approved by the Board of Directors and should be reviewed on a regular basis, or at least annually.

Responsible corporate governance is important to us. Having in place clear decision-making procedures is the key to responsible corporate governance and we follow set procedures throughout the Bank to ensure that all our dealings are handled professionally. Arion Bank was recognized as a model company in corporate governance in 2015 following a formal assessment of the management and Board of Directors. Further information on Arion Bank's corporate governance can be found here.

Arion Bank was recognized as a model company in corporate governance in 2015

Risk management is a critical component of our business and it is our aim to ensure that risk management remains everyone’s business. Risk management is discussed in more detail here.

Combatting financial crime benefits society

Financial crime can cause severe damage to society and undermine trust and the effectiveness of the financial system. Arion Bank takes its responsibilities to protect its customers and the assets under the Bank’s care seriously by fighting financial crime.

We seek to prevent financial crime and the damaging impact it can have on our customers, our business and society. In order to be able to this the Bank provides its employees with the appropriate training and education, maintains effective monitoring and collaborates closely with the law enforcement authorities. The Bank is also aware of the risk of conflicts of interest which inevitably occur in our business and we have taken special measures to prevent conflicts of interest from negatively affecting our customers' interests.

We prioritize measures to prevent:

- Money laundering, terrorist financing and violations of trade sanctions

- Conflicts of interest

- Market manipulation and insider misconduct

- Fraud and corruption

One of the most important measures to prevent financial crime is to know the people we are working with or doing business with well. The Bank checks the background of people working on its behalf and obtains information on its customers, both from the customers themselves and from official sources, such as Registers Iceland and the Register of Companies.

One of the most important measures to prevent financial crime is to know the people we are working with or doing business with well

Automatic monitoring is one of the measures employed by the Bank to prevent financial crimes. The Bank has various computer systems in place to identify suspicious transactions or customers who may fall into a risk category in terms of corruption, money laundering or terrorist financing. The Bank is also vigilant towards cyber-attacks, an increasing threat as digital banking gains popularity.

However, no form of monitoring is as effective as an alert employee. Employees undergo regular training where they learn to recognize suspicious behaviour. Once a year employees take a test to ensure that their knowledge of money laundering and how to prevent it is adequate. Another test is taken annually to ensure employees have adequate knowledge on the handling of confidential information. In addition the Bank holds numerous courses, such as on the Bank's competition compliance policy, conflicts of interest and measures to tackle market manipulation.

Employees undergo regular training where they learn to recognize suspicious behaviour, and they have to take regular tests

Employees are urged to report any suspicions they may have of financial crime, whether on the part of a fellow employee, business partners or customers. Employees can send anonymous tip-offs and the Bank keeps the source of its tip-offs confidential unless otherwise dictated by law. All reports of potentially illegal conduct are investigated by the Bank's internal control units and referred to the relevant law enforcement authorities as required.

Better banking

Providing first-class services to our customers is at the heart of what we do. This means developing good relationships with our customers, responsible lending, offering top quality financial advice and encouraging people to save money. We want to enable our customers to do their banking when and wherever they want, and therefore one of our key tasks in 2016 was to further expand our range of digital services.

We listen to the voice of our customers because their satisfaction and experience is important to us. We regularly perform surveys where we ask how likely it is that our customers would recommend our services to others. In 2016 we laid the foundations for measurements of individual service factors so that we can make improvements to the underlying services.

We listen to the voice of our customers because their satisfaction and experience is important to us

Good relationships are the key to understanding our customers’ needs. Arion Bank is a relationship bank which aims to develop long-term relationships with customers by offering expertise, outstanding service and diverse services.

We are grateful for all suggestions and recommendations we receive. In order to keep track of how we can do a better job, we document all these suggestions and try to act upon them. We also keep a record of all ideas and praise we receive and direct them into the appropriate channels. In 2016 we recorded around 8,500 suggestions, ideas and compliments from customers.

In 2016 we recorded around 8,500 suggestions, ideas and compliments from customers.

We look at these suggestions as an opportunity to improve and to do better today than we did yesterday. Many of these suggestions have resulted in improvements to the way we do things and in some cases have been the source of major technological changes which have had a wide-reaching positive impact on our business and the services we provide to customers.

Digital services

We aim to be the leading digital bank in Iceland. We are increasing the availability of our digital services so that customers are able to serve themselves as conveniently as possible.

We are simplifying and automating procedures, making things more straightforward for the customers and our employees. We utilize the data from our research to make good decisions and we aim to develop creative solutions which our customers find stimulating.

Taking full advantage of technology allows us to accommodate our customers whenever and wherever it suits them. Technology enables us to know our customers, and to understand and meet their needs. We are there for people who want to do their banking at home or via a smartphone, but we are also there for people who want to come and meet us in person.

Technology enables us to know our customers, and to understand and meet their needs

Great advances were made in digital services at Arion Bank during the year. People can now become customers of the Bank online using eID, a valid credit appraisal can be performed in a few minutes on our website, customers can open new deposits accounts and obtain credit cards, transfer money to anyone using the Arion app and spread out credit card bills with one click. With even more digital solutions in the pipeline, banking is becoming more and more straightforward for our customers.

Financial literacy

One of the services we provide and one of our responsibilities towards society is to share our financial expertise with our customers. Our customers have easy access to information on their own finances, including via the Arion app and the online bank. We also offer advice on personal household finance to improve people’s grasp of their own finances and we hold a wide range of finance courses.

The rapid development of financial services and the multitude of available options can make finance a complex and difficult topic but financial literacy gives people a better overview of their own finances and the options available to them. Financial literacy covers a range of topics, from personal finances, making budgets and setting targets, to decisions such as buying a house or choosing a pension scheme. Major financial decisions can have a huge impact on people’s quality of life but by improving financial literacy people can make informed decisions and lay the foundation for financial stability.

Major financial decisions can have a huge impact on people’s quality of life but by improving financial literacy people can make informed decisions and lay the foundation for financial stability

We make every effort to offer our customers quality financial advice. In 2016 six employees qualified as financial advisers, bringing the total to 53 at the Bank.

As in previous years we also held a diverse range of courses and information meetings on various aspects of finance and we thereby helped our customers and the wider community better understand the range of choices available and to take informed decisions on their own finances. It is important to start early and we have placed special emphasis on promoting financial literacy among the younger generation. We have held a number of well-attended financial courses for children and teenagers across Iceland. Arion Bank is the main sponsor of the Institute for Financial Literacy whose aim is to improve financial literacy in Iceland.

We actively participate in the debate on financial and economic issues in Iceland and promote open discussion by organizing a range of meetings and conferences on various financial topics.

- A total of 10 seminars were held across Iceland at which economist and entertainer Jón Jónsson discussed money and finances with 1,000 teenagers aged 14-16. We have also arranged courses with Jón for 16-18 year olds.

- Breki Karlsson, director of the Institute for Financial Literacy, held a series of talks on financial literacy in both the Reykjavík area and outside the capital which were open to the general public.

- A total of 500 people attended information meetings on pension savings held by the Bank.

- Arion Research held 18 public meetings in 2016 which attracted more than 1,300 visitors. Arion Research appeared in numerous interviews in the media and provided input to various meetings and conferences.

- The Icelandic Financial Services Association (SFF) has been running a project called Fjármálavit (Money Matters) whose aim is to improve financial literacy among teenagers and Arion Bank is participating in the project. More than 20 employees of Arion Bank took part in the project in 2016.

- A total of 8,500 people attended seminars, conferences and other events organized by the Bank in 2016. Over 10,000 people attended events at the Bank’s headquarters in 2016. Arion Bank organized and/or participated in 114 events which attracted 47,000 visitors in 2016.

Lean management

Since 2012 Arion Bank has adopted lean management, the aim of which is to eliminate waste and improve efficiency. 99% of the Bank's employees have now received training and education in lean management. The basic principle is to put the customer at the centre of what we do and minimize whatever does not increase the value of the service. Continuous improvements play a key role in the process, i.e. we are continuously seeking to enhance our services and do better today than we did yesterday. The goal in 2016 was for each employee to record and complete six improvements and we easily surpassed this, with the average number of completed improvements being 8 per employee, or almost 7,000 in total.

99% of the Bank's employees have now received training and education in lean management

In autumn 2016 Arion Bank organized a well-attended conference on lean management at the Bank’s headquarters. The goal was to share our experience of introducing lean management, discuss what has worked for us and what can be learnt from the whole process. The conference was primarily aimed at corporate clients of Arion Bank and other interested parties.

An attractive place to work

Arion Bank employs an integrated team of hard-working employees. We endeavour to look after our people and strive hard towards creating a stimulating and positive work environment in which we can all grow and develop our skills.

We have a clear equal opportunities policy, which is to guarantee equal opportunities and terms for employees of both sexes and to be an attractive place to work for both women and men. The Bank has an equality committee and we have formulated an equality action plan. The Bank signed the CEO Statement of Support for the Women’s Empowerment Principles (UN Women) and the UN Global Compact, which is an international benchmark for companies whose aim is to empower women in companies and increase their influence in society.

In 2015 Arion Bank became the first Icelandic bank to be awarded Equal Pay Certification by the labour union VR. This entails the implementation of a quality system for salaries and decisions on salaries. The Bank needs to pass regular inspections of its procedures and salary analyses by independent inspectors in order to retain this certification and in 2016 the Bank met the standard required. The Bank also achieved its aim of reducing the explained wage gap by one percentage point between years. The inspection made in June 2016 showed that the wage gap between men and women in similar jobs was 3.7%. The goal for 2017 is to bring the gap down to 3.0% or less.

In 2015 Arion Bank became the first Icelandic bank to be awarded Equal Pay Certification by the labour union VR. This entails the implementation of a quality system for salaries and decisions on salaries

A workplace audit is carried out every year in order to improve the working environment and to enhance job satisfaction. A healthy balance between work and private life is important and employees are also encouraged to look after their health. There is zero tolerance towards bullying, sexual harassment or any other inappropriate behaviour, and we have established a policy and regulations on how to deal with conduct of this nature.

In 2016 approximately 200 courses were held for the employees. The number of employees attending these courses was around 2,500, which corresponds to approximately three courses per employee. In addition many employees went to regular lunchtime lectures titled "Building relationships". These lectures are open to all employees and the aim is to keep employees abreast of what's going on at the Bank and inform them of the different projects being undertaken.

Human resources is discussed in more detail here.

Creative economy

One of our main focuses at Arion Bank in terms of sustainability is to help stimulate a creative economy. In recent years we have collaborated on a wide range of exciting investment projects with our customers with the aim of strengthening the business sector in this country. We have tried to ensure that companies under our ownership but operating in non-banking sectors are sold in stages to a diverse group of owners and listed on the stock market. Arion Bank has been involved in more than 60% of IPOs in the past few years, thereby contributing to the regeneration of the Icelandic stock market and adding to the number of investment options on the general market.

We firmly believe that cultivating innovation has a positive impact on society and we are therefore dedicated to supporting innovators, including by providing them with access to advice and funding and by helping companies in product development. Arion Bank works with and for entrepreneurs and seed companies, as well as investors. Art and design are also major factors in creating an economy characterized by creativity and innovation and Arion Bank provides strong backing to such activities.

INNOVATION

Innovation can transform ideas and knowledge into new technology, new ways of doing things or even new industries in both established companies or at the seed investment stage. All endeavours to innovate, develop and create new value are important and we take such enterprise seriously and carefully consider whether and how we can provide our support.

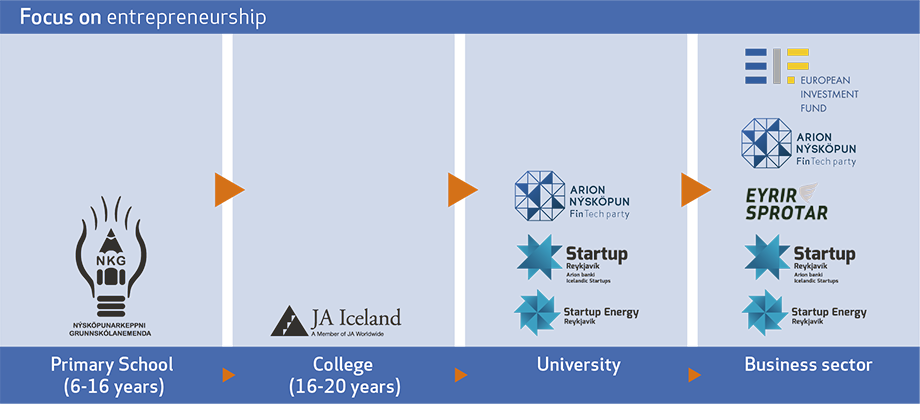

We want to create fertile ground and a positive and stimulating atmosphere for innovation and seed companies in Iceland and we offer diverse ways and financial solutions to support individuals and companies achieve their future goals. Arion Bank supports innovation from primary schools to universities and all the way to the workplace.

We want to create fertile ground and a positive and stimulating atmosphere for innovation and seed companies in Iceland and we offer diverse ways and financial solutions

Popular business accelerators

.jpg) Startup Reykjavík is Arion Bank’s main seed investment programme. Its objective is to create an environment where entrepreneurs can receive advice and guidance from experienced mentors in order to realize their ideas and thereby create new business opportunities. Participating teams are offered seed funding in the form of equity, training and working facilities where entrepreneurs have the opportunity to meet and exchange ideas. The teams are also given the opportunity to present their business ideas to Icelandic and international investors with a view to discussing how to develop the ideas and raise future funding. Startup Reykjavík is wholly owned by Arion Bank but the business accelerator is run in collaboration with Icelandic Startups. Startup Reykjavík was named the best business accelerator in the Nordic region in 2015 and the best one in Iceland in 2015 and 2016 by the Nordic Startup Awards.

Startup Reykjavík is Arion Bank’s main seed investment programme. Its objective is to create an environment where entrepreneurs can receive advice and guidance from experienced mentors in order to realize their ideas and thereby create new business opportunities. Participating teams are offered seed funding in the form of equity, training and working facilities where entrepreneurs have the opportunity to meet and exchange ideas. The teams are also given the opportunity to present their business ideas to Icelandic and international investors with a view to discussing how to develop the ideas and raise future funding. Startup Reykjavík is wholly owned by Arion Bank but the business accelerator is run in collaboration with Icelandic Startups. Startup Reykjavík was named the best business accelerator in the Nordic region in 2015 and the best one in Iceland in 2015 and 2016 by the Nordic Startup Awards.

Startup Reykjavík was named as the best business accelerator in Iceland in 2016 at the Nordic Startup Awards.

Startup Energy Reykjavík (SER) is a business accelerator based on the same template as Startup Reykjavík but it focuses on projects and companies in the energy sector. It was launched in the spring of 2014 and seven companies took part. A further seven companies participated in the spring of 2015, followed by seven more in 2016. SER is a collaborative project between Arion Bank, Landsvirkjun, GEORG, Innovation Center Iceland, Icelandic Startups and Iceland Geothermal.

The number of applicants to the two business accelerators clearly illustrate the great need for seed funding and active mentoring for seed companies.

Funding a company as it takes its first steps is generally of critical importance. Companies which have gone through SR and SER have received additional funding following their participation in the business accelerators. At the beginning of 2017 companies had received ISK 2,600 million in funding in the form of equity and grants.

Collaboration with European Investment Fund on loans to SMEs

Arion Bank began collaborating with the European Investment Fund, EIF, in 2016 and now offers funding for small and medium-sized enterprises who are planning to bring innovation into their business, whether in the form of new products, procedures or services. The aim of this partnership is to provide companies with access to funding at lower interest rates once certain conditions have been met and thereby to support innovation, stimulate business activity, research and development. The loans are intended for SMEs planning to invest in:

- New production

- Introducing new products, procedures or services

- Development

- New methods

- Technology

The EIF guarantees a part of the loan provided by Arion Bank and the customers benefit from the partnership by paying lower interest rates.

The EIF guarantees a part of the loan provided by Arion Bank and the customers benefit from the partnership by paying lower interest rates.

The European Investment Fund is owned by the European Investment Bank and partners 74 financial institutions in 29 European countries. Arion Bank is the only bank in Iceland which is collaborating with the European Investment Fund.

One of the largest shareholders in venture capital fund Eyrir Sprotar

Arion Bank, in cooperation with Eyrir Invest, runs the venture capital fund Eyrir Sprotar slhf. Eyrir Invest and Arion Bank are the fund's largest shareholders and in 2016 the Bank upped its investment to ISK 1.3 billion.

Arion Bank, in cooperation with Eyrir Invest, runs the venture capital fund Eyrir Sprotar slhf. Eyrir Invest and Arion Bank are the fund's largest shareholders.

Never too early to start

Arion Bank is one of the main sponsors of the NKG innovation competition which is intended for students in the 5th-7th grade. A total of 1750 ideas were entered in 2016 and 27 were selected to compete for the top prize.

The Bank is also one of the main sponsors of Junior Achievement Iceland. The role of the organization is to prepare young people for the future and to improve their skills for the job market by promoting education in innovation, entrepreneurship and business at secondary school level. Innovation is presented to students with the aim of fostering the spirit of entrepreneurship and training the innovators of the future. In 2016 more than 300 students from eight schools took part and this number is set to grow over the next few years. The aim is to give Icelandic students the opportunity to experience innovation first hand in the classroom. Arion Bank is one of four sponsors behind the project.

Arion Bank the first company to host a hackathon

In June 2016 Arion Bank became the first Icelandic bank to host a hackathon at which participants in cross-discipline teams developed FinTech solutions using a sandbox API from Arion Bank and other providers. Twelve teams did their best in this 30-hour competition at the Bank's headquarters. By hosting this event Arion Bank sought to stimulate collaboration between Icelandic entrepreneurs and companies on the development of new financial solutions and services to individuals and companies.

Supporting innovation at many levels of society

It is our view that by supporting innovation at various levels of education and different stages of a company's development we are fostering an environment in which an even more varied business sector can prosper in the future.

By doing this Arion Bank is supporting innovation all the way from primary school to the workplace.

Art and design

Arion Bank organizes art exhibitions and lectures on the visual arts at its headquarters on a regular basis. The Bank owns a sizeable art collection containing works by many of Iceland's leading artists and these works are on display at Arion Bank's branches and places of work.

In February 2016 Arion Bank and the Iceland Design Centre signed a 3-year partnership agreement. This partnership includes Arion Bank’s support for DesignMarch, one of the Iceland Design Centre’s main venues for promoting Icelandic design and ingenuity. Arion Bank was also one of the main sponsors of the conference DesignTalks, which was held on 10 March 2016 at the Harpa Concert Hall and marked the start of DesignMarch. The conference brought together a number of international designers who shared their expertise and experience with those in attendance.

In February 2016 Arion Bank and the Iceland Design Centre signed a 3-year partnership agreement. This partnership includes Arion Bank’s support for DesignMarch, one of the Iceland Design Centre’s main venues for promoting Icelandic design and ingenuity

The Iceland Design Centre also arranged the DesignMatch event with Arion Bank at our headquarters. DesignMatch is best described as speed dating for designers, buyers and manufacturers. Designers get the opportunity to present their ideas and designs and to start up business relationships with a personal touch. Business relationships are crucial when turning a good idea into reality.

In April 2016 an exhibition of works by Kristinn E. Hrafnsson was opened at the Bank's headquarters. The exhibition was opened with a lecture on Kristinn’s works by art historian Gunnar J. Árnason. The exhibition contained various work from Kristinn’s 30-year career and new work he did for a separate exhibition. An exhibition of works owned by the Bank was also held in the headquarters, displaying recently acquired works, a video installation by Egill Sæbjörnsson, photography by Katrín Sigurdardóttir and paintings by Hulda Stefánsdóttir.

Respecting the environment

At Arion Bank we have great respect for the environment and seek to minimize any negative effect operations may have on the natural world. Environmental awareness runs through the company from top to bottom.

Environmental issues are very important to us and we have tried to closely monitor the environmental impact of our activities. The Bank has launched numerous projects designed to reduce our environmental impact. We have invested in electric cars for running errands around town during working hours, introduced a transport policy for employees, supported forestry, improved waste sorting, and cut down on printing. Our focus on digital services is critical in reducing our ecological footprint and that of our customers.

The Bank has launched numerous projects designed to reduce our environmental impactArion Bank seeks to minimize the negative environmental impact of its activities. The Bank’s environmental objectives are to:

- Sort waste produced by the Bank as much as possible

- Use energy sparingly

- Use environmentally friendly solutions when printing by using new technology

- Encourage employees to adopt environmentally friendly practices at work and at home

- Choose environmentally friendly products and/or services wherever possible

- Increase the number of paperless transactions

- Reduce waste

City of Reykjavík and Festa’s Declaration on Climate Change – mapping our ecological footprint

Man-made climate change is one of the main challenges facing us today. Arion Bank signed the City of Reykjavík and Festa’s Declaration on Climate Change in November 2015 and since then we have been methodically mapping the Bank's ecological footprint and further reducing pollution from our activities. An important step was taken when we implemented environmental software from the Icelandic innovation company KGS.

Arion Bank signed the City of Reykjavík and Festa’s Declaration on Climate Change in November 2015 and since then we have been methodically mapping the Bank's ecological footprint and further reducing pollution from our activities

In 2016 Arion Bank issued its first environmental report, covering 2015. The report set out the Bank’s environmental targets and an action plan to reduce the environmental impact of activities which the Bank followed in 2016. In 2016 the Bank’s total carbon footprint, from the factors being measured, was 8.85% lower than the previous year, down from 1028 tons to 936 tons.

In 2016 Arion Bank issued its first environmental report, covering 2015

We look at environmental projects as a journey to be taken over the next years and we aim to get a better overview of factors which have a negative environmental impact.

Arion Bank's 2016 environmental report contains further information on our main tasks, achievements and goals on environmental issues.

Supporting the community

Arion Bank supports numerous organizations, companies and projects in the community. We sponsor the Institute for Financial Literacy, Harpa Concert Hall, the Iceland Design Centre, the Icelandic Handball Federation, the Icelandic Sports Association for the Disabled, NKG Innovation Competition and Junior Achievement Iceland. Arion Bank's branches also support various projects in their local communities.

In February 2016 Arion Bank and the Iceland Design Centre signed a 3-year partnership agreement. This partnership includes Arion Bank’s support for DesignMarch, one of the Iceland Design Centre’s main venues for promoting Icelandic design and ingenuity.

Arion Bank was one of the main sponsors of an international conference held at Harpa Concert Hall in April 2016 under the title Social Progress – What works? The subject of the conference was the Social Progress Index, which is a new method for measuring the prosperity and competiveness of different nations based on social factors, not economic as has generally been the norm. At the end of the year Arion Bank and Cognitio signed a 3-year partnership agreement on the conference which will be held in Reykjavík for the second time in the spring of 2017.

Arion Bank was one of the main sponsors of an international conference held at Harpa Concert Hall in April 2016 under the title Social Progress – What works? The subject of the conference was the Social Progress Index

During the year Arion Bank provided special backing to women in music. In June Arion Bank, KÍTÓN (Women in Music), and Kex Hostel signed an agreement on a series of concerts at which Icelandic women would perform once a month at Kex Hostel. The purpose of KÍTÓN is to create a dialogue and foster solidarity among women in the Icelandic music scene.

Arion Bank’s Community Day was held in May. A team of employees and their families spent the day tidying up and doing a variety of jobs around several community residences. In connection with this day and the 80th anniversary of the founding of the Bank's employees' association, the Bank donated ISK 25,000 per employee, a total of ISK 22 million, to various charitable causes for children. Each employee could decide which charity they wished the donation to be made to.

A team of employees and their families spent the day tidying up and doing a variety of jobs around several community residences

We also provide support to the Icelandic Cancer Society and the Icelandic Red Cross, and our branches support diverse sport and cultural activities in their home towns.

Partners